25th Annual TV Preview: Ad-Supported Streaming is Alive & Well

Consumers today have become accustomed to an on-demand lifestyle influencing many aspects of their lives, ranging from health and fitness to grocery delivery, eCommerce and of course, television. Try telling a four-year-old in today’s world that they can’t watch Paw Patrol because it’s “not on” and watch them subsequently talk into a remote only to prove moments later that, sure enough, it’s available.

Consumers today have become accustomed to an on-demand lifestyle influencing many aspects of their lives, ranging from health and fitness to grocery delivery, eCommerce and of course, television. Try telling a four-year-old in today’s world that they can’t watch Paw Patrol because it’s “not on” and watch them subsequently talk into a remote only to prove moments later that, sure enough, it’s available.

Having access to content on-demand is an opportunity for both consumers and advertisers – it is truly a win-win.

According to Nielsen, streaming accounted for nearly 25% of total TV usage in Q2 2020. Of that time spent streaming, 73% of viewing was made up of the “Big 4”: Netflix, YouTube, Hulu and Amazon, with Disney+ adding another 4%. The remaining quarter is a mixed bag made up largely of media conglomerate direct-to-consumer subscription products (i.e. CBS All Access) and free AVOD (ad-based video on demand) providers like Roku, Pluto, Tubi and others. And while roughly 45-50% of this collective streaming does not include in-program ads (Netflix, Amazon and Hulu’s ‘no ads’ product), half of streaming inventory is ad-supported.

Despite ad-supported streaming accounting for over 10% of all TV viewing, advertising spend hovers around 3%. This disproportionate budget allocation is further compounded by the fact that, according to MRI, streamers generally tend to be more affluent and exhibit higher propensities for early adoption and digital shopping than their non-streaming counterparts.

The ratio of viewership to ad spend is expected to course-correct in 2021 as both linear ratings and spend projections continue to decline. We believe the accelerated adoption of streaming during the pandemic is likely a permanent shift, and the 25% viewing figure will continue to increase. As the viewing audience grows and marketers seek out new, more targeted, and younger TV audiences, ad spending against streaming TV is expected to surge.

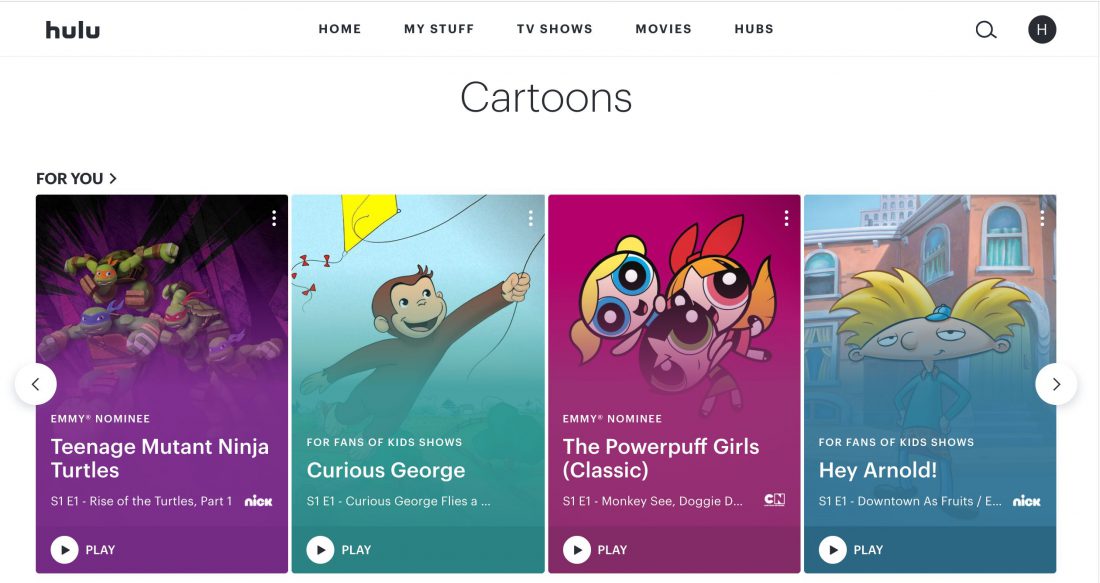

This is especially important for advertisers looking to bring down the age of their TV audience. According to SpotX, the majority of ad-based (AVOD) viewers are between the ages of 18-34. While this audience is less affluent than its subscription-based (SVOD) audience counterparts, their future potential makes them extremely important for advertisers looking to build brand loyalty. When coupled with that slightly older, more affluent Hulu audience and expanding “TV-like” programming offered on YouTube, advertisers have a diversity of ad-supported options through which to reach streaming TV viewers.

The streaming ecosystem continues to expand as media conglomerates launch direct-to-consumer products. Within the past year alone, Disney+, HBO Max (Warner Media), and Peacock (NBC) were all rolled out to market. Both HBO Max and Peacock will be fully ad supported in 2021, meaning that advertisers will have two more large ad-supported platforms to add to the mix for reaching consumers.

More services, however, means more fragmentation and this is perhaps the biggest obstacle advertisers face when opting to go the streaming route. How much should I allocate to streaming TV? Which providers do I use? How can I manage my frequency? How can I add reach without duplicating audiences? Like many emerging platforms, there is not one streamlined solution. Instead, advertisers must lean on agency partners to inform the best approach to maximize impactful reach with their target audiences. As with most media decisions, the right approach will vary by audience, advertiser, and business goal, and be driven by the strategic role TV is meant to play in the media plan. But knowing what options are out there, who is watching them, and perhaps most importantly, which ones will actually take your ad dollars, is half the battle. After that comes the fun part… taking the campaign to market.