26th Annual TV Preview: Video Trends

BY DAN COX, VICE PRESIDENT

KEY THEMES DEFINING THE TV LANDSCAPE:

-

- Accelerated fragmentation is not just a 2020 thing

- COVID-driven TV viewing shifts will be maintained

- 2021 defined by an endless stream of video content

- As streaming offerings expand, so do advertising opportunities

- Advanced TV is maturing; advertising adoption (and ad spend) will follow

THE SHIFT TO DIGITAL CONTINUES

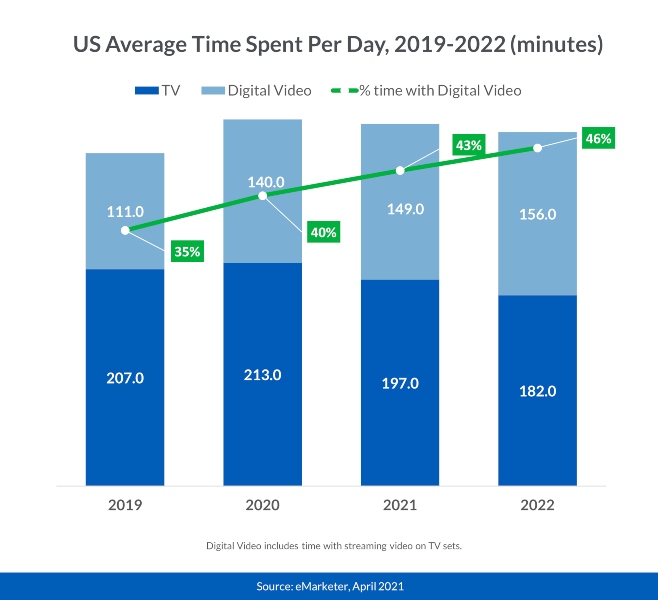

COVID-19 drove significant increases in video consumption in 2020, seen across linear TV and digital video. TV has leveled off, settling in below pre-COVID levels but remaining at 56% of total time spent. Digital video – driven largely by a massive migration to Connected TV (CTV) – continues to see steady growth.

Since 2018, time spent with CTV devices has nearly doubled, now representing roughly 25% of all A25-54 TV viewing. While streaming TV growth has been seen across all age groups since COVID, viewing shifts have been most accelerated with older adults, where CTV accounts for nearly 13% of total A50-64 TV viewing. For many viewers, embracing new technology & platforms was accelerated by COVID-19… and there is little indication that these behavioral shifts will revert.

MORE PLATFORMS & STREAMING SERVICES THAN EVER

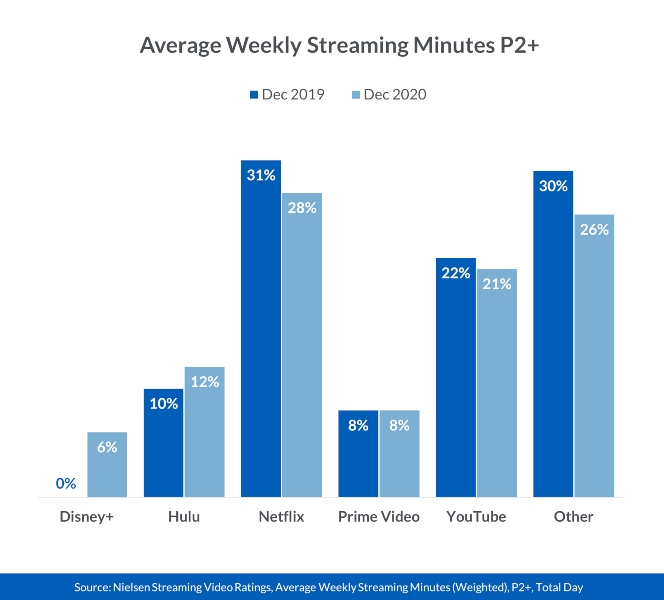

While many households are cutting the cord on traditional cable in favor of internet-enabled TV-connected devices and subscriptions to streaming services, even more are keeping both; stacking streaming services on top of their existing cable or satellite subscriptions. In addition to stacking linear and streaming TV, consumers are also stacking OTT subscription video services at increasing levels.

As streaming TV grows, so does content fragmentation. The “Big 5” became a “Big 6” with the arrival of Disney+ and promises to expand further with the emergence of offerings like Peacock, Paramount+, HBO Max and sustained growth among the AVODs (Advertising-Based Video on Demand), such as PlutoTV and TubiTV.

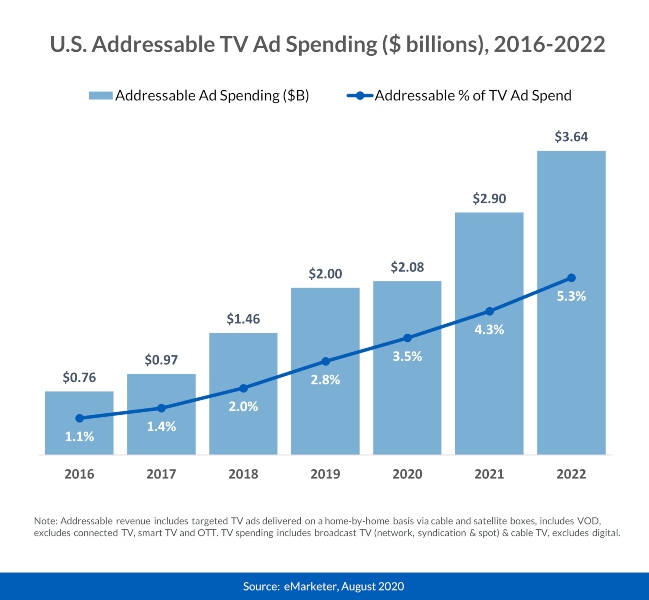

ADDRESSABLE TV ALSO PRIMED FOR MAJOR GROWTH

Historically focused around local ad inventory, often limited to two minutes of commercials per hour, addressable TV is primed for expansion as national networks – which sell 14 to 15 minutes per hour – continue to get more involved. As addressable inventory grows, ad spends will follow. This, plus a broader economic recovery in 2021, will help addressable TV rebound from a slow 2020.

LOOKING AHEAD: NAVIGATING THE LANDSCAPE

Evaluate Premium Content Mix – Maximize video impact by aligning with changing viewer patterns accelerated by COVID, including shifts in daypart mix, program selection and platform

Increase Non-Linear TV Allocation – Consider increased weight in OTT and set-top on-demand to capitalize on accelerated TV fragmentation sustained into 2021

Continue to Monitor Advanced TV for Local Options – With addressable opportunities expanding, ATV adoption will rise and should be something to watch for future video planning

Download our full 2021-22 TV Preview here. For more information contact us.