Ad Recess During Recession?

With a potential recession on the horizon and consumer sentiment uncertain, is this the right time for brands to pull back advertising dollars?

From a business perspective, it may seem to be the rational move given the unknowns of how brands will fare once a recession truly takes shape. News stories continue trending as major retailers assess expected profits and consumers continue tightening their purse strings. This further perpetuates the question – what is the right level of advertising support in the foreseeable future?

Given increasing inflation, consumers are understandably being more cautious of where every dollar is spent. Consumers are feeling the pricing pinch with the cost of everyday goods on the rise; from gas to groceries, no matter if you are single or supporting a family, the pinch is real. While higher-end products may take a backseat first, products used daily are not immune to being eliminated from the grocery cart, or at least being purchased less frequently.

Everyday brands may temporarily feel unscathed, however a review of past recessions – and subsequent impacts – indicate that brands cutting advertising dollars ultimately suffer long-term. Pulling back advertising dollars not only can hurt long-term brand equity and ROI, but consumers could be swayed to try a competitor that remains active or make the switch to private label.

When uncertainty lies ahead, consumers take comfort in what’s familiar, and “familiar” comes from maintaining brand equity as people become more discerning with their purchases.

A look back at 2008

With eCommerce in its infancy, the 2008 recession sparked significant acceleration in online shopping growth and marked the demise of many brick-and-mortars. Consumers reprioritized what was important and looked for company leaders to step up and provide more transparency. As consumers started to reestablish trust with brands, it was the brands that stayed the advertising course and focused on consumers which ultimately benefited. This is similar to what we are facing today.

An Analytic Partners study which reviewed 1,000+ brands that continued to advertise during the recession saw a 17% ROI incremental sale increase. Findings showed it was not a matter of cutting back or focusing on the short-term, but rather keeping focused on long-term outcomes.

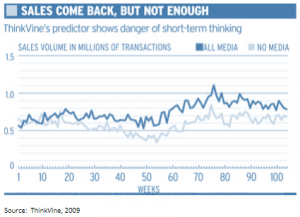

This ThinkVine study further supports these findings, indicating that “loss of sales from going dark cannot be caught up even when brands start to advertise again.”

In short, brands that remain top-of-mind tend to net out ahead, as they are often seen as consistent and reliable.

What does this mean in a pandemic-fueled recession?

As the world tries to get back to the “new normal,” advertisers must be mindful that many consumers have shifted their priorities. In many ways, COVID-19 has ultimately changed consumer behavior in the short and long-term. Convenience and health-first options are top of mind for consumers; and should be for advertisers as well.

As these new behaviors become the norm, brands have less opportunity to be an on-the-spot purchase, making it even more imperative for a brand to remain front and center in consumers’ minds. It’s not whether to advertise or which brands should be advertising, it’s about the messaging. The message needs to change to address this new consumer sentiment.

By maintaining an advertising presence during economic downturns, brands could see less competition in the marketplace in the near-term, allowing those brands that advertise to leverage a greater share-of-voice (SOV) than in other periods. Brands can also benefit from more advantageous pricing as advertising cuts lead to increases in available inventory. As the aforementioned Analytic Partners study indicates, continuing with or increasing media spend during a recession can drive elevated growth, equity and ROI.

Ultimately, the benefits of advertising outweigh the initial bump brands may see in their short-term ROI if they cut back. Building long-term equity must be at the forefront of advertiser decisions. With unpredictable times on the horizon, now is the time for brands to provide a sense of security to consumers. In doing so, they stand to gain not only short-term impact, but long-term trust, loyalty, and brand growth.

For more information contact us.