Political Advertising & the Media in 2020

Total ad expenditures next year will very likely set a record as media companies expect significant increases in political spending, including direct candidate spending, Political Action Committee (PAC) spending and other issue advertising. Kantar recently provided a very conservative estimate of $6 billion in political spend, but that is only accounting for federal candidates and campaigns during the 2020 election year. With total 2018 mid-term spending hitting $8.7 billion, many prognosticators expect that number to grow to $10 billion in 2020. This would represent a 59% increase over the $6.3 billion spent in 2016.

Total ad expenditures next year will very likely set a record as media companies expect significant increases in political spending, including direct candidate spending, Political Action Committee (PAC) spending and other issue advertising. Kantar recently provided a very conservative estimate of $6 billion in political spend, but that is only accounting for federal candidates and campaigns during the 2020 election year. With total 2018 mid-term spending hitting $8.7 billion, many prognosticators expect that number to grow to $10 billion in 2020. This would represent a 59% increase over the $6.3 billion spent in 2016.

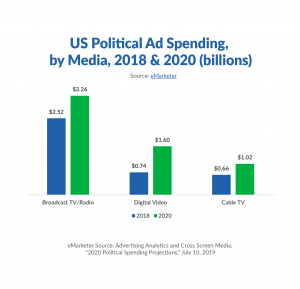

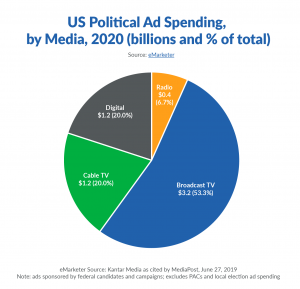

Broadcast television will be the largest recipient of political advertising and is projected to reach approximately $3.2 billion, followed by cable and digital ($1.2 billion each), and radio ($400 million). This estimate doesn’t include PACs and local races (non-federal) which would considerably increase these estimates.

While local broadcast TV is expected to retain most of the political spending, digital media and cable will see higher growth rates from past election cycles. Additionally, there will be considerable spending on streaming video content watched on over-the-top (OTT) devices and connected TVs (CTV), none of which were a major factor in previous presidential elections.

The advantage of cable is its ability to use enhanced data to reach more highly targeted groups of viewers. Congressional candidates are expected to embrace new options for data-optimized, advanced TV placements. Cable’s cross-screen products (Video on Demand (VOD), OTT, digital screens) will also be utilized to reach lighter TV viewers.

To close the gap between cord-cutters/shavers/nevers/stackers, candidates and PACs will embrace an OTT/CTV strategy more than any previous year, allowing candidates and special interest groups to extend their reach and target younger voters. This includes content providers such as Hulu, Sling TV, Roku, YouTube TV and others. Tru Optik estimates that political ads on OTT/CTV platforms will range from $500 to $720 million in the year.

Attempting to quantify the projected spend in the emerging digital video bucket is notoriously challenging. While media intelligence companies Advertising Analytics and Cross Screen Media do not project category spend in the same manner as Kantar, their forecasts for TV and cable are very similar. The primary difference is that unlike Kantar, they provide a specific spending estimate for digital video, which is expected to exceed cable spend in the upcoming cycle.

Overall, digital political advertising is expected to increase significantly as campaign managers are much more digitally savvy this election cycle. Kantar estimates $1.2 billion in digital spend, but they concede that the share of political dollars in digital is still a great unknown. Digital projections are based on spending on paid digital ads or ads which are delivered by a platform that is sponsored by a candidate or campaign.

Paid social media has become a major tool for political campaigns and other organizations that target voters. Campaigns have strongly embraced the channel in the early stages of campaigns due to its ability to help candidates organize, attract volunteers and raise funds. Social media giant Facebook/Instagram is tightening their political rules by adding new disclosure requirements for political ads placed on their platforms. They are introducing a “confirmed organization” label for U.S. political advertisers who show government-issued credentials to demonstrate their legitimacy. All advertisers running political or social issue advertising will also have to post their contact information. Advertisers who do not comply will be shut off. However, Facebook continues to be under fire for its policy to not fact-check advertising published by politicians. While Facebook isn’t the only platform that has run ads with false statements, they have received the most flak for it. They have recently been wavering on their stance, as they just took down an ad from a political action group – not a politician – noting that different rules apply.

Twitter CEO Jack Dorsey famously issued a ban on political ads, stating, “We believe political message reach should be earned, not bought.” Twitter just released the first iteration of their policies banning political ads, and appear to have changed course on their issue ads ban. They continue to roll out details of their policy, which they say will now allow ads with messages about issues such as civic engagement, the economy, the environment and social equity – but they cannot advocate for, or against, a specific political, judicial, legislative, or regulatory outcome related to those matters. So, for example, a group could place an ad warning against the dangers of climate change but can’t encourage the passage of the Green New Deal. Political advertising on Twitter represented just $3 million in the 2018 midterms, a rounding error based on their $3 billion in total revenue during that year.

Twitter CEO Jack Dorsey famously issued a ban on political ads, stating, “We believe political message reach should be earned, not bought.” Twitter just released the first iteration of their policies banning political ads, and appear to have changed course on their issue ads ban. They continue to roll out details of their policy, which they say will now allow ads with messages about issues such as civic engagement, the economy, the environment and social equity – but they cannot advocate for, or against, a specific political, judicial, legislative, or regulatory outcome related to those matters. So, for example, a group could place an ad warning against the dangers of climate change but can’t encourage the passage of the Green New Deal. Political advertising on Twitter represented just $3 million in the 2018 midterms, a rounding error based on their $3 billion in total revenue during that year.

Google’s current stance on political advertising is to restrict how narrowly political advertisers can target voters on the company’s services. This move puts more pressure on Facebook to enact controls. Starting in January, Google political advertisers will only be able to target broad categories like gender, age and zip code, and not detailed targeting such as voter records or political leanings.

Google’s current stance on political advertising is to restrict how narrowly political advertisers can target voters on the company’s services. This move puts more pressure on Facebook to enact controls. Starting in January, Google political advertisers will only be able to target broad categories like gender, age and zip code, and not detailed targeting such as voter records or political leanings.

LOCAL POLITICAL IMPACT & TIMING ON BROADCAST TELEVISION

Prior to election dates, there are specific political windows that impact advertising rate levels within active markets. The primary political window is 45 days prior to the election date; in the general election, it’s 60 days prior to the election. So nationwide, the political window will open on September 5th for the November 3rd general election date. The primary windows will vary state by state and DMA by DMA.

In the political windows, all legally declared federal political candidates have the right to reasonable access and to receive the lowest unit rate/cost (LUR/LUC). This means the stations cannot refuse a candidate’s ads and may not charge political candidates any more than the lowest rates they charge a commercial advertiser for the same class of time as the candidate’s spot. These conditions often lead to rate increases for non-political advertisers within the political window, as well as a near absence of no-charge bonus spots unrelated to TRP underdelivery weight. Many candidates place TV buys in advance of the official window, but they do not receive protected LUR status outside of the 45- or 60-day windows.

Super PACs and issue groups are not held to any political window conditions and will advertise at any point in time throughout the cycle. These advertisers often cause pre-emptions, as they are willing to pay significantly higher rates to guarantee placement.

Stations will give priority to protecting the schedules of candidates and PAC/issue, both of whom must pay for schedules in advance of the air date. The full impact of PAC advertising is not yet known. So far, the Democratic candidates have mostly rejected support from Super PACs. Most PAC/issue advertisers, however, operate independently from a candidate’s campaigns, and are expected to be extremely active in 2020.

Demands on inventory and the higher rates paid by issue advertisers will drive rate increases on spot TV during political windows. Additionally, this pricing pressure will be felt throughout 2020 as advertisers with flexible scheduling move activity to other weeks/months of the year to avoid these political windows.

Effects will vary by market. Rate increases in spot markets vary greatly depending upon the importance a state can have in the outcome of a race in relation to the electoral votes. Swing states attract significantly more attention than solidly blue or red states. Senate, congressional and/or gubernatorial races in a market can often have more of an impact on demand and pricing than the presidential race.

The TVB offers the TVB Guide to 2020 Political Races & DMAs. This tool details which states are hosting elections and the status of the elections in terms of expectations to lean Democratic or Republican, as well as the toss-ups, with total electoral college votes by state. This information should be considered by local advertisers when planning 2020 campaigns.

Local Timing

All local advertisers need to be aware of election timing in their trade areas. The states that will have the first presidential primaries or caucuses are Iowa, New Hampshire, South Carolina and Nevada, which will all be held in February. Super Tuesday is March 3rd and will encompass 14 states, including California for the first time.

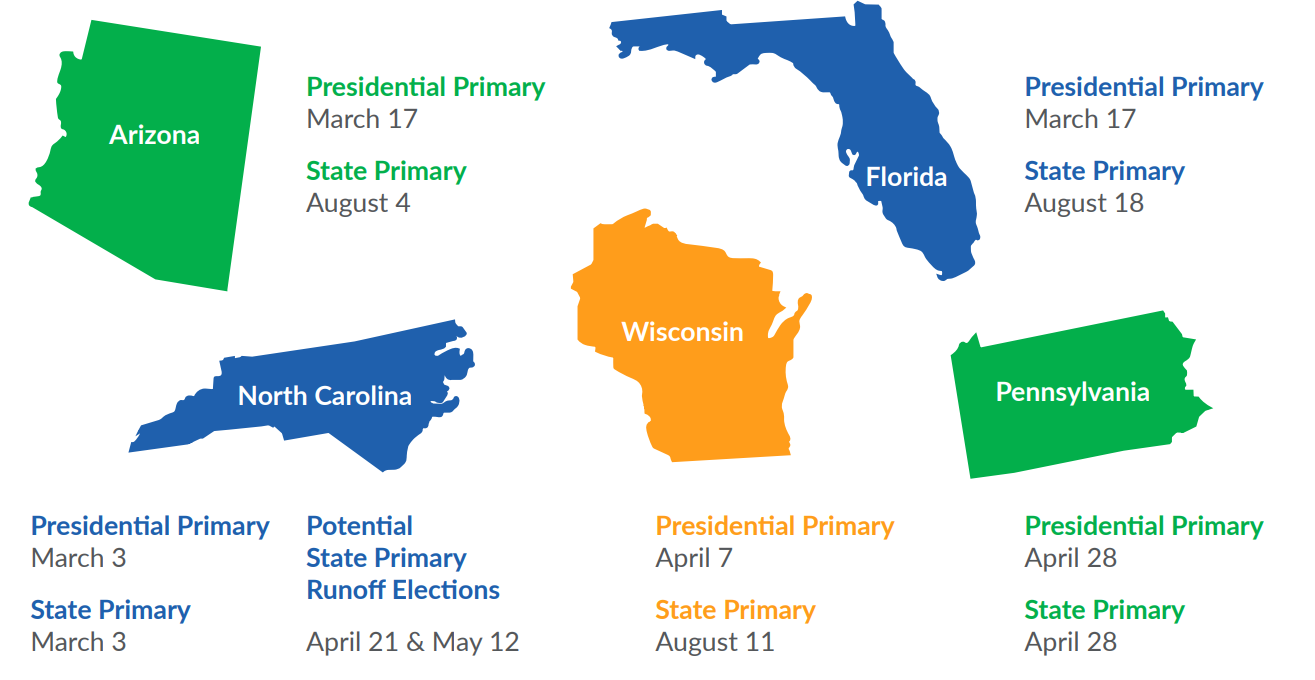

The earliest 2020 state (non-presidential) primaries are held on March 3rd and the latest are in mid-September. June and August are the busiest months for state primaries. Some states have two primary windows – a presidential primary window, and a state primary window. As mentioned earlier, primary windows open 45 days prior to the election date. Of the five expected toss-up states (AZ, FL, NC, PA, WI), three of the five will have two primaries during the 2020 cycle.

- Arizona’s presidential primary is March 17, and the state primary is August 4

- Florida’s presidential primary is March 17, and the state primary is August 18

- Wisconsin’s presidential primary is April 7, and the state primary is August 11

- North Carolina’s presidential and state primaries are March 3, with potential state primary runoff elections on April 21 and May 12

- Pennsylvania’s presidential and state primaries are both on April 28

The National Conference of State Legislatures (NCSL) provides a full list of 2020 State and Presidential Primary Election Dates.

MITIGATING THE IMPACT OF A HEAVY POLITICAL SEASON ON TV PLANNING AND BUYING

The following steps can be used by advertisers to lessen the impact of political ad spending on TV:

- Avoid political windows whenever possible, particularly during the later parts of each political window, when political ads account for a larger percentage of commercial activity in key dayparts/programs.

- Understand the markets and timing by using the tools linked in this paper. The TVB will continue to update their information as primaries move and candidates’ positions in the market change, so check the status often.

- Buy early and plan for pre-emptions. Early buying will help to manage rate increases and best maintain planned schedules. Prepare a plan for identifying acceptable makegoods and allowing for spot movement outside of the originally intended on-air weeks.

- Limit the use of news programming (early morning, early news, late news) as well as cable news networks (CNN, FOX News and MSNBC). These dayparts and networks will be heavily impacted by political spending. Consider that over half of all spots in news dayparts will be political, even though local news represents only a fraction of overall programming.

- Consider alternative video solutions, including CTV/OTT, which will see lighter impact than spot TV. These publishers and video providers are working now to increase scale. Consider (and monitor) commercial pods that are typically smaller than those on traditional TV.

Other options beyond broadcast TV and cable:

- Hulu does accept political ads, however they are not regulated like linear TV, so they do not preempt and will not be extending ad breaks. All pods on Hulu will stay 90 seconds long and when ads are booked, inventory is guaranteed. Again, early placement is recommended.

- Movie theater video venues do not accept political or issue advertising. This video offering can be compared with premium/primetime TV.

- Radio, including streaming audio, experiences less stress on inventory compared to TV, with the exception being News/Talk and Urban formats. Pandora has no plans currently to increase spot load (one or two spots per pod for audio) or charge premiums to engage. They do accept political advertising, so book early.

- Newspaper (both print and digital) readership may be more attentive during the election cycle as voters turn to strong editorial voices, so this is a good option for older targets.