Table for Two: The Return of Sit-Down Dining and the Impact on QSR

Download PDF

Introduction

In April 2021, Harmelin Media surveyed 800 QSR diners between the ages of 18-49 to understand their changing attitudes toward sit-down dining and how QSR and CDR restaurants would be impacted by the changes. Our analysis uncovered some potential hurdles that can negatively impact quick serve visitation, but also some opportunities to capitalize on the increased mobility accompanying mass vaccinations and the lifting of occupancy restrictions. In this post we will summarize the findings from our study and offer practical suggestions to QSR/CDR marketers to improve share of stomach at this most critical time.

INSIGHT #1: Almost 40% of QSR diners may cut back on fast food after the re-emergence.

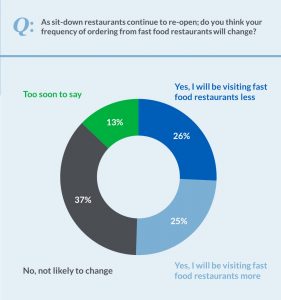

Our survey showed that 26% of respondents agree that the freedom to go to sit-down restaurants will decrease their QSR usage, while another 13% told us, “It’s too soon to say.” Fortunately, another quarter expects to increase their patronage of QSR, based upon increased mobility as things return to a ‘normal’ state.

To us, this means that it is more important than ever to understand and segment diners more effectively, prioritizing those who are likely to increase visitation over those who will substitute sit-down dining for QSR. Ultimately, this means increasing efficiency and effectiveness while decreasing potential advertising waste.

INSIGHT #2: Older QSR users are getting back to ‘normal’ dining habits more quickly.

This makes sense, because in our survey, they were 16% more likely to be vaccinated than younger (18-34) diners. In fact, among 35-49 year-olds, 62% either have eaten or are ready to eat inside a sit-down restaurant (a number that is surely growing daily).

Given QSR’s reliance on younger diners, there may be a slight delay before the impact of sit-down dining is felt, but it is coming!

INSIGHT #3: Despite the many marketing messages out there, people choose what they crave.

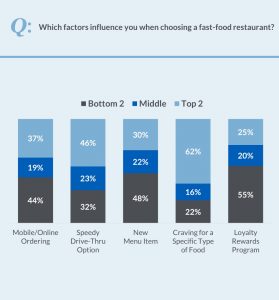

When there’s so much focus on third-party delivery, drive-thru, online ordering and LTO promotions, it can be easy to forget that the most critical factor leading consumers to pick a quick serve restaurant is… the desire for a specific type of food on a given day. In fact, 62% of our respondents rank their current food craving as the main driver for where they choose to eat.

As QSRs market themselves, don’t forget the basics, especially the power of top-of-mind awareness and mouthwatering food imagery. When people get the craving for tacos, or burgers, or chicken, or subs… make them think of your brand first!

INSIGHT #4: Rewards are not the driving force for choosing where to eat… but they do reinforce behavior for heavy users.

Rewards are a double-edged sword. How do you gain the benefits to drive incremental purchase and visitation without discounting items that people would have bought anyway?

And while consumers do respond to rewards programs, they are not a driving force for deciding where to eat (only 25% of our survey respondents indicated that rewards were a primary factor). Of course, when consumers do sign up for a loyalty program, they expect value and they expect choice. 73% want to redeem points for items of THEIR choice and 59% expect regular discounts on items purchased.

Advanced technology is increasingly becoming a powerful tool to address individual consumer needs. A customer data platform (CDP) can store extremely granular customer information linked to a unique ID, which allows marketers to better predict what items provide the best upsell opportunities, and allows for increased personalization in messaging and offers to each reward card holder. Consumers like when we showcase that we understand their tastes and desires. With a CDP we can build a better bond with consumers that enables them to feel more confident in the brands they choose.

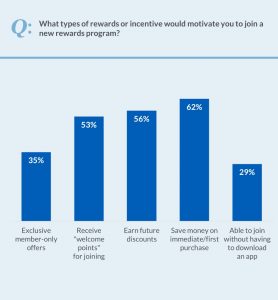

INSIGHT #5: Diners expect both immediate and long-term value when joining a rewards program.

This should shock nobody… people want discounts both now and later. Of course, ‘value’ is a highly individualized concept and different diners will respond to different motivators. One size certainly does not fit all. Most diners expect immediate savings and rewards, but more than half expect future discounts and over a third look for exclusive, member-only benefits.

As stated above, personalized messaging enabled by a CDP or other similar technology can improve response rates and increase diner satisfaction with a loyalty program, which drives incremental sales and incremental visits. Matching the ‘desired’ value to the ‘delivered’ value has never been more important for restaurants.

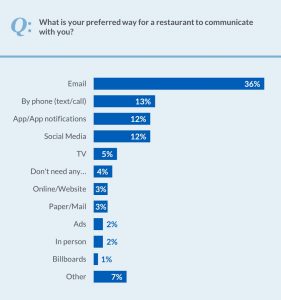

INSIGHT #6: More people want to hear from you via their inbox, but other channels offer more robust engagements.

It’s important to understand how best and how often to talk to diners if they’ve granted you their personal information in the form of an email address or cell phone number for text messaging. Consumers value their privacy and restaurants that overuse their access risk losing it. Three times as many respondents said they prefer email communication to either SMS, mobile apps or social media. However, those latter platforms allow for richer, two-way engagements, so despite the smaller numbers, they may prove to be a better investment than easy-to-skip emails.

RECOMMENDATIONS

Given our findings, Harmelin’s QSR specialists have identified six action steps that restaurant marketers can use to fight off increased competition and make the most of their marketing investments.

- Re-engage on breakfast

No daypart has been impacted more by changing commuter patterns during the pandemic than breakfast. And with many white-collar businesses committing to increased hybrid or work-from-home environments, this daypart will continue to present challenges. However, as it relates to competition from sit-down restaurants, breakfast is the least likely daypart to be impacted, and may represent a short-term opportunity to recapture lost meal occasions from diners choosing sit-down restaurants at the expense of QSR.

- Follow mobile traffic patterns

With a quarter of consumers more likely to choose QSR and a quarter less likely, it is more important than ever to know who is who. Partnering with a mobile location company can provide discrete insights into which people fall into each group, allowing for direct messaging through the phone and advanced profile building for marketing via other channels.

- Invest in a next-gen data platform

CDPs allow highly granular analysis of, and targeting to, diners. This allows restaurants to deliver the right message and/or offer to drive the most value. With the increase in digital privacy restrictions (such as Google Chrome going cookieless and the onset of Apple’s iOS14.5 platform), first-party data is going to become an even more important commodity for a competitive advantage. A CDP is a worthy investment to address today’s marketplace dynamics.

- Make your food the hero

Yes, you need to communicate cleanliness, safety, delivery and takeout options, family meals, store hours, LTOs and rewards. But don’t make the mistake of overlooking the craveworthy look, smell and taste of your most popular menu items to drive diner traffic.

- Be recent

In a previous study, we documented the huge portion of diners who decide where to eat at the moment they leave their home or office. Restaurants that can time their messaging to these key moments of decision will gain advantage. And since the mobile device goes everywhere we do, take whatever steps you can to “own the phone.”

- Do it now

After fifteen months of disruption, consumers are forming brand new habits as they emerge. Never before has the opportunity to shift market share been this great – it is a literal ‘land grab.’ This is the time to be brave and to take advantage of the development of diners’ “new normal” patterns.

HARMELIN’S QSR PRACTICE

We understand the challenges restaurants face driving non-deal traffic, inspiring repeat visits & customer loyalty, and increasing average check size.

Our insights and experience will help you to efficiently reach and motivate more customers, driving same store sales and traffic across targeted meal occasions.

We use a data-driven approach to identify high-value diners, engage with them in meaningful ways and message them to drive action. Just as important, we measure, validate and optimize constantly to improve performance of paid media and marketing efforts.

Our toolkit includes digital and traditional paid media, influencer marketing, CRM activation, content marketing, local listings management, SEO and more… all supported by a deep team of marketing analysts using our proprietary suite of software tools to generate new insights that grow ROAS.

For more information contact us.