From ad strategies and regulatory shifts to looming legislation and eroding trust, the healthcare industry is facing a pivotal moment but are organizations ready to respond?

When Healthcare Ads Hit the Sweet Spot and When They Get Too Personal

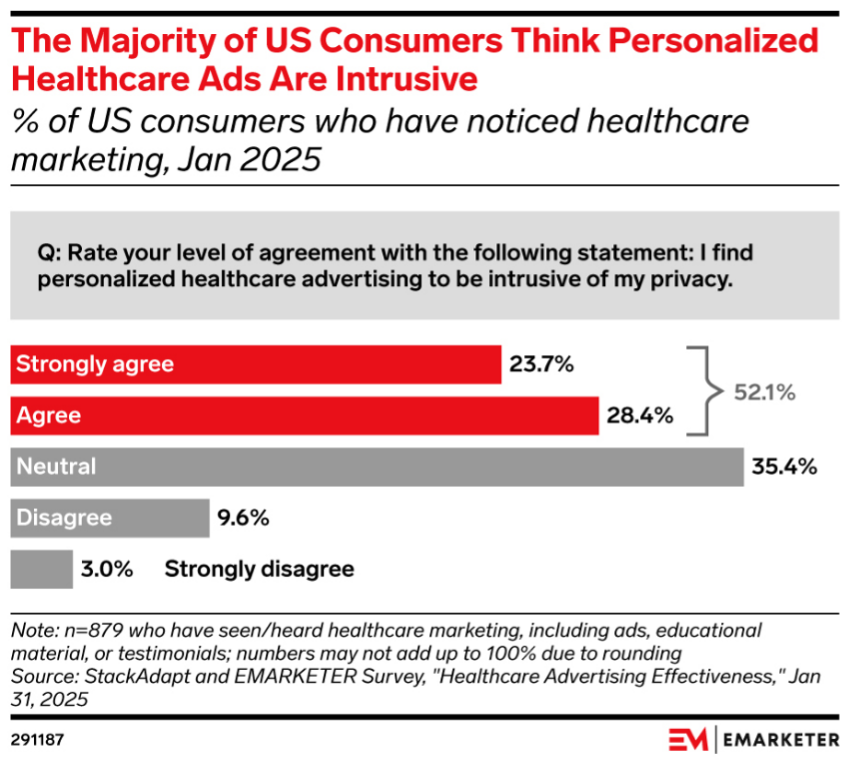

Serving the right message to the right audience is always a goal for marketers but in healthcare, personalization can go too far. According to Emarketer and StackAdapt’s “Healthcare Advertising Effectiveness Survey” in January 2025, healthcare ads are moving consumers to take action while also raising privacy red flags.

In a breakdown of consumer responses to healthcare advertisements we see: 34% of consumers researched information online after seeing a healthcare ad, 24% discussed the ad with a healthcare professional or insurer, 20% consulted family or friends, 16% clicked on the ad, and 13% ultimately purchased the product or service. These insights highlight the importance of informative and trustworthy advertising in influencing consumer behavior.

However, privacy concerns persist with 52% of consumers saying that they feel that personalized healthcare ads intrude on privacy. 64% are concerned about how their healthcare data is used by advertisers, with only 10% feeling comfortable with how their information is being used.

Consumers engage with personalized ads, but the research shows there is a limit, and we as marketers can go too far. The best way forward is to use technology to target efficiently while being clear with consumers about why they were targeted.

Future Proofing Healthcare: The Merger Movement Ahead

The Trump administration revoked a Biden-era Executive Order on competition in August. The order was intended to boost competition and break up monopolies across all sectors. The reversal demonstrates the differences the two administrations have on government regulation policy.

This move signals eased regulatory oversight at the federal level, more streamlined merger reviews, and increased opportunity for hospital system growth through mergers. This also indicates that mergers will be evaluated on a case-by-case basis rather broadly opposing transactions.

States continue to have input in approving mergers. Attorneys General are taking a more active role as federal oversight decreases. Healthcare companies should consider the state’s approach and history relative to mergers.

Source: https://www.modernhealthcare.com/providers/mh-trump-executive-order-anti-competition-ftc

What Does the OBBBA Mean for Your Business?

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, brings major changes to the healthcare landscape, impacting Medicaid, Medicare, and the Affordable Care Act (ACA). This far-reaching legislation will touch consumers and impact all healthcare sectors. Hospitals, Insurers, and consumers are all trying to understand the implications.

The Act aims to reduce federal healthcare spending and increase oversight of Medicaid and ACA programs, with provisions like work requirements for Medicaid recipients, stricter eligibility checks, and changes to ACA premium tax credits. These changes are projected to reduce federal spending by over $1 trillion over a decade but also lead to 10.9 million losing coverage and create challenges for healthcare systems and payers alike.

Impact on hospitals:

More uninsured Americans will mean a surge in uncompensated care for all hospitals.

Delayed care will put strain on Emergency Departments as patients arrive sicker.

Regulatory/compliance changes will present an administrative burden for hospital staff. Rural and critical access hospitals — already under financial stress — face an even steeper cliff as payments remain flat despite rising need. Children’s hospitals rely heavily on Medicaid funding, as it provides coverage for a significant portion of their patients.

Impact on insurers:

Insurers will feel the $910 billion in reimbursement reductions from federal programs.

ACA subsidies will expire, pushing younger, healthier members out of the market, increasing adverse selection and medical loss ratios, and raising commercial insurance rates. Higher churn rates due to work requirements and eligibility re-verifications will add to administrative burden.

Impact on consumers:

Millions of Americans face simultaneous loss of insurance and social supports and most notably coverage through Medicaid and nutrition through SNAP. Community health centers and local public health infrastructure may be especially affected, leading to gaps in maternal health, behavioral health, and immunization programs. These disruptions will disproportionately impact low-income and rural populations. Young adults aged 19–29 are expected to face the largest loss of insurance. Finally, the public will suffer confusion while adapting to several changing conditions at once.

What are healthcare organizations doing to prepare now?

Hospitals have adopted AI to streamline workflow, repetitive tasks, records, etc. It cannot stop there. Hospitals are continuing to seek AI-powered efficiencies across documentation, staffing, procurement, claims processing, and more.

- Manage operational costs through Group Purchasing Organizations, rethinking supply chains and procurement strategies to reduce costs.

- Work with local health departments to reduce duplicative services.

- Where relevant, apply for the Rural Health Transformation Program funding.

Insurers can prepare for new documentation requirements by training staff and upgrading systems now. Adopt AI solutions to track eligibility, detect fraud, and target members for retention.

As the Trust Gap Grows, Why Do Consumers Distrust Healthcare Information?

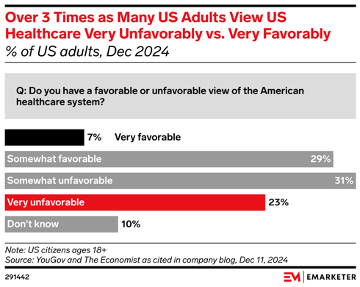

The COVID era damaged consumer trust in healthcare information, no matter the source. No entity in our industry is spared, according to the Emarketer’s “Consumer Distrust in Healthcare 2025” report.

Of those surveyed:

- 66% blame insurers,

- 60% blame pharmaceutical companies and costs,

- 42% blame politicians,

- 34% cite fraud, waste, and abuse, and

- 23% blame healthcare providers.

COVID was a catalyst for this shift in sentiment. Over half of U.S. adults feel that public health officials misled them about COVID-19 vaccines and masking. Political partisanship plays a role here as well. We see that you are more likely to trust government health guidance when your political party is in power.

Big Pharma is blamed by 60% of those surveyed for the problems with U.S. healthcare. 78% answer that they are primarily focused on profits over helping patients. The argument that R&D is what drives costs does not seem to be landing with the American public.

Trust in hospitals has fallen since the pandemic. In 2021, 77% believed that providers were more motivated to deliver high quality care than to make profits. In 2025, that number is down to 31%, according to a Jarrad survey.

Americans seem to feel that insurers’ coverage delays and denials are a major problem, with 29% having this experience themselves. Only 28% surveyed by Gallup report that their coverage is good or excellent, a 16-year survey low.

This erosion of trust is leading to younger adults taking medical advice from unexpected sources like friends, family, and social media. Research shows that 54% end up regretting a health choice made based on unreliable information. We can speculate that this will also lead to lower immunizations and the inevitable problems that will result.

What can the industry do to win back trust?

- Hospitals can use local trusted authorities to engage with neighborhood-level social groups and local, trusted media. Engage in social media to reach younger people with reliable information and respond to comments.

- Insurers and pharmaceutical companies can own previous missteps by addressing transparent explanations for controversial decisions.

- Show the public what is behind medical advice to build trust in your research-backed recommendations.

Source: https://content-na1.emarketer.com/consumer-distrust-healthcare-2025#page-charts

For more information, visit harmelin.com, or connect with us on LinkedIn or Facebook.