Navigating the pressure of Inflation with Rewards

As the caution of inflation from 2022 has become a 2023 reality, QSR brands are facing a multitude of challenges in keeping their customers engaged. While there are signs of inflation slowing, falling from 7.1% in November 2022 to 6.5% in December 2022, the modest retraction will not reverse the course for consumer spending.

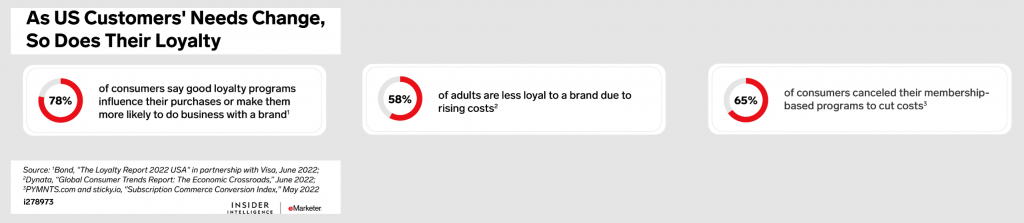

For QSR brands, rewards and loyalty programs have proven to be effective mechanisms for increasing visitation and growing basket size – but that’s when things are going well and consumers spending. As consumers retract, a refocus on these programs is critical.

Source: https://www.insiderintelligence.com/content/what-retailers-need-know-2023-5-charts

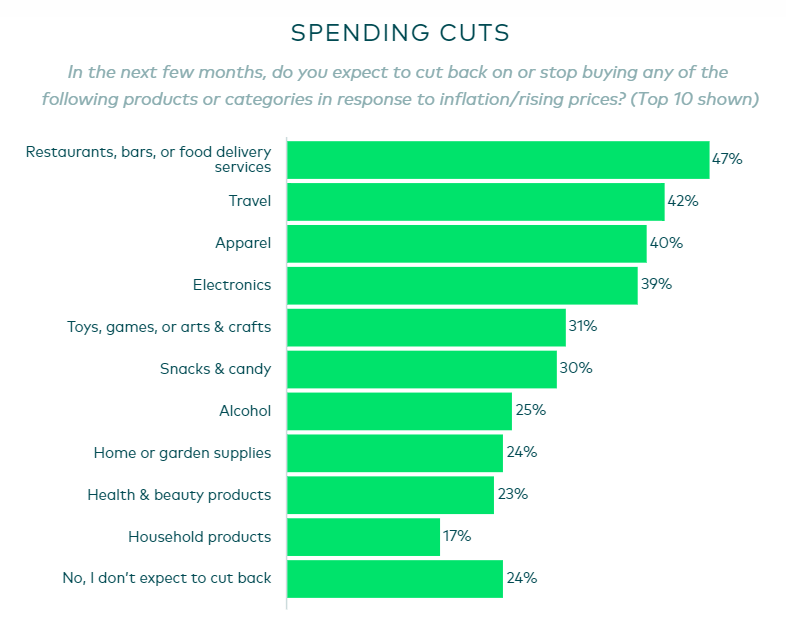

The fact is consumers are spending less and QSR destinations will be the first to feel it. In Numerators’ December edition of their Monthly Consumer Sentiment Survey, restaurants, bars, or food delivery services topped the list of consumer spending cuts.

As if inflation concerns weren’t enough, with news of sweeping job cuts in technology, retail, and finance seemingly making headlines every day, consumer instability will continue deep into 2023, so QSR brands should prepare for the long haul.

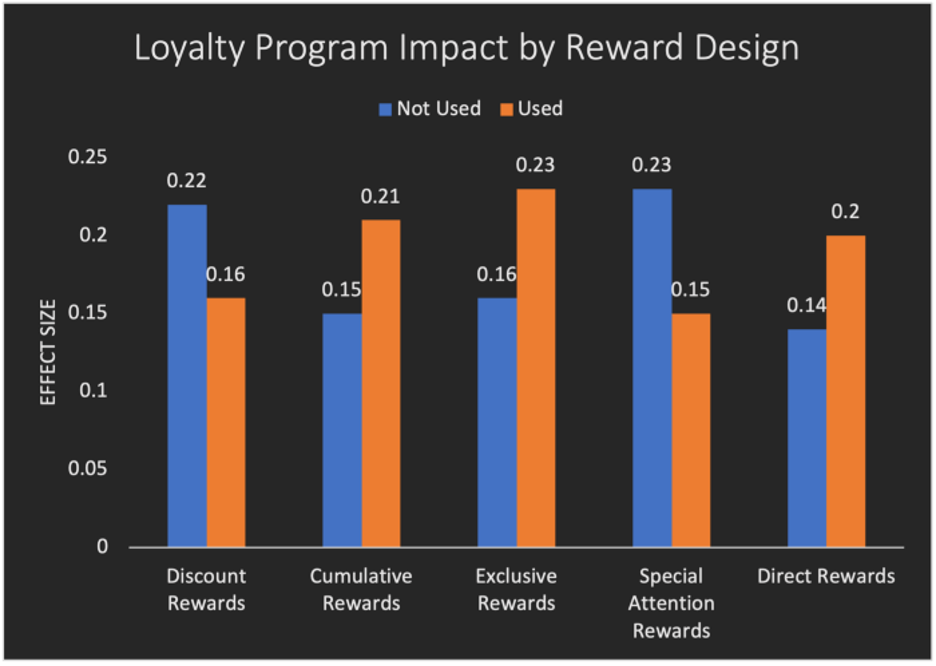

While QSR businesses are likely to see a drop in total visitation and orders, many QSR businesses are seizing the opportunity to deepen their relationship with their most loyal customers by reworking their rewards programs.

Starbucks, the world’s largest restaurant brand, is making changes to its notoriously revered rewards program. Starbucks reworked the redemption rates for many popular items, dropping items like Iced Coffee from 150 to 100, while doubling up other items, increasing the redemption rate from 50 to 100.

Meanwhile, Dunkin Donuts is experimenting with different rewards models in an effort to keep their loyalists engaged, but not at the expense of the bottom line. Unfortunately for Dunkin, early response has been negative, as consumers perceive the changes to be misaligned with their needs.

In both cases, Starbucks and Dunkin are demonstrating the delicate balance of change management in an unstable consumer sentiment environment, and the stakes – their loyal customers – are high.

QSR leaders: If you are considering launching, relaunching, reimagining, or reworking your rewards programs to navigate the pressures of declining visitation rates and smaller basket sizes, reach out to us to discuss ways to activate paid media that can support your rewards program and keep your most loyal customers happy.