The Post-Pandemic Online Grocery Shopper: Executive Summary – Five Key Insights

INTRODUCTION

INTRODUCTION

The grocery store has been ground zero for changes in consumer behavior facilitated by the pandemic. Consumers immediately started clearing the shelves of products and supply chains were interrupted. Store managers and staff were designated “essential workers” and quickly pivoted to face a new reality to ease the fears of a public in panic.

Once a category that relied heavily on the in-store experience, the traditional grocery store was largely caught flat-footed, and struggled to keep up with the new dynamics of eCommerce. To its credit, the category became a case study in agility, experimentation and relentless dedication to a customer-centric approach, it is still evolving today. However, two large, looming questions remain:

What do the online grocery shopping habits of consumers look like in a post-pandemic world?

How should grocery marketers prepare for this new future?

Harmelin Media explored these questions through a combination of primary research and secondary sources to provide grocery chains and CPG marketers with actionable insights and recommendations.

UNDERSTANDING THE SHIFTS IN ONLINE GROCERY SHOPPING

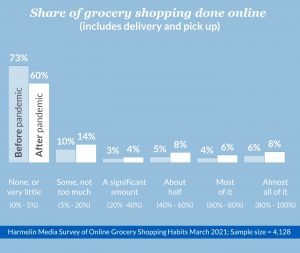

To better understand the nature of shifts in online grocery shopping, we fielded a survey of over 4,000 consumers comparing habits before the pandemic, and anticipated changes as we emerge from the pandemic.

This report is an executive summary of the key findings and just scratch the surface of our research and implications.

INSIGHT #1: I STILL LOVE MY GROCERY STORE.

-

-

60% of shoppers will still do virtually all their shopping (95%+) in-store (Online Grocery Shopping Habits, Harmelin Media, March 2021).

-

74% of shoppers expect to do the vast majority of shopping (80%+) in-store (Online Grocery Shopping Habits, Harmelin Media, March 2021).

-

Implications: This is good news for grocery stores and proof that old habits die hard. In fact, there is likely significant latent demand for the in-person experience among people who have not been able to visit the store during the pandemic.

This will be a great opportunity to market in-store-only promotions to drive brick-and-mortar traffic while surprising and delighting customers with new in-store experiences as we emerge from the pandemic.

INSIGHT #2: ONLINE GROCERY SHOPPING IS GETTING STICKY.

20% of all grocery shopping will be online, a 44% increase vs. pre-pandemic levels (Online Grocery Shopping Habits, Harmelin Media, March 2021).

Implications: New habits are forming quickly. Online grocery shopping became a necessity during the pandemic, and it will remain an important part of the grocery shopping routine for the foreseeable future. In fact, previous forecasts had predicted that online grocery shopping would reach 21% by 2025 (Mercatus, eGrocery’s New Realty, September 2020). The lingering effects of the pandemic have condensed 5 years of projected growth into 12 months.

The omni-channel grocery shopper has arrived, and grocery stores must ensure that their infrastructure and business models can accommodate the needs of the new consumer.

INSIGHT #3: eCommerce… Intended for Mature Audiences

1 in 3 shoppers aged 45-54 will buy 20% or more of their groceries online (Online Grocery Shopping Habits, Harmelin Media, March 2021).

Implications: While many digital trends have been led by younger age segments, the age group that will have the highest share of significant online grocery shopping (20% or more) is among adults age 45-54 (index = 126). The second highest group is for adults ages 35-44 (index =123) and skews female (index = 108).

Online grocery shopping is not a habit of a fringe cohort of shoppers. It is impacting a broad spectrum of shoppers and being adopted by the core grocery shopper the most. Marketers should take heed and ignore this at their own peril.

INSIGHT #4: “In-store = Food; Online = Supplies”

71% of online grocery sales are comprised of non-food products (IRi eMarket Insights, IRi, October 2020).

Implications: The online grocery shopper is in a different mindset than the in-store shopper that is meal planning. Online grocery shoppers are buying non-perishable items such as skincare products, vitamins, pet supplies and laundry detergent.

It’s critical to make this distinction in your marketing messaging and promotional strategies. Fresh food is still synonymous with the in-store experience, while consumer are more comfortable purchasing non-food items online. Grocery retailers need to leverage this dynamic to optimize and cross-promote buying channels.

INSIGHT #5: Online shoppers go top-shelf

2.2x more likely to buy super-premium brands when shopping online for food (The Premium Opportunity, IRi, November 2020).

Implications: When grocery shoppers go online to buy food items, they use the opportunity to pamper themselves with premium brands like Rao’s pasta sauce, Ghirardelli chocolate, and high-end beer and wines. In fact, 38% of grocery eCommerce tend to be super-premium, compared to just 17% of in-store grocery sales.

The online shopping experience is a great opportunity to get customers to try new things. Dynamic messaging and strategic promotions can increase profitability while improving the customer experience by upselling to premium and hard-to-find brands through digital channels.

THREE KEY TAKEAWAYS

1. Stop thinking about your customers as in-store shoppers vs. online shoppers.

Consumers are now omni-channel and require omni-channel marketing strategies. Don’t overreact to the shift to online shopping at the expense of driving in-store traffic. You must orchestrate a dynamic strategy that combines brick-and-mortar + online shopping, customer acquisition + loyalty marketing, delivery + pick-up, premium brand + promotions, food + supplies, and many more dimensions.

2. Invest in a robust and integrated customer identity solution.

The new multi-channel customer is not a monolithic group. Their grocery needs, purchase journeys and profiles and are much more nuanced, requiring depth of understanding at the individual level and micro-cohort level. This requires a marketing tech-stack that includes a Customer Data Platform (CPD) to aggregate, unify, append and analyze customer data at scale.

3. Double down on agile and personalized messaging in both owned and paid media.

Understanding your customer is not enough. Retailers must use that insight to deliver more meaningful and relevant experiences across media channels. Retailers also need to connect their customer data insights with dynamic digital experiences (website and app) and addressable media channels such as digital advertising, advanced television targeting, video and audio streaming, and programmatic direct mail solutions.

HARMELIN MEDIA’S RETAIL PRACTICE

We are retail specialists, driving customers into both brick & mortar locations and eCommerce platforms.

To thrive, retailers need to adapt to constantly changing consumer demands. Consumers expect ease, variety, and positive shopping experiences. This means that to succeed, retailers must be innovative in their approach and develop new solutions for customer acquisition and retention. Years of collective experience help Harmelin Media take advantage of current trends and identify proper targets to ensure precise message delivery.

Through rigorous research, strategic planning, and a results-oriented approach, we provide you with retail advertising solutions to make your voice heard through improved brand/consumer communication. By integrating strategy, planning, and negotiation, we help you grow your business and maximize ROI. Thanks to our vast network of partners and intimate industry knowledge, we help you anticipate your consumers’ future interests, stay ahead of the top media trends and navigate the constantly shifting media landscape.

For more information contact us.