27th Annual TV Preview: Video Trends & Conclusion

BY DAN COX, SENIOR VICE PRESIDENT | CATHERINE NILAN, MEDIA STRATEGIST | ILANA MITTLEMAN, MEDIA STRATEGIST | SARAH WILSON, MEDIA ANALYST

KEY THEMES DEFINING THE TV LANDSCAPE:

-

- Time spent streaming continues to rise across most demos

- Consumer stacking of OTT subscription services seems headed for a plateau

- Inflation (and saturation) facilitating subscriber churn, as growing field of providers compete for limited dollars

- Advertising opportunities continue to expand, as more streaming services roll out ad-supported models

THE SHIFT TO DIGITAL CONTINUES

-

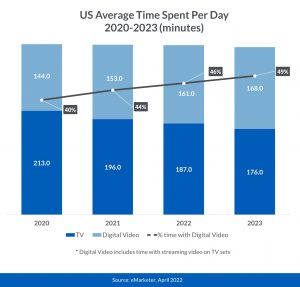

- COVID-era spikes in overall video consumption have sustained, dropping off only slightly since 2020

- Digital video – driven largely by widespread migration to CTV – continues to see steady growth

AS STREAMING TV GROWS, SO DOES FRAGMENTATION…

-

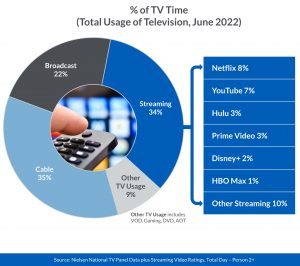

- Linear viewing still constitutes the majority of television usage

- Streaming time continues to rise across a widening array of providers

…YET SUPPLY MAY BE OUTPACING DEMAND

-

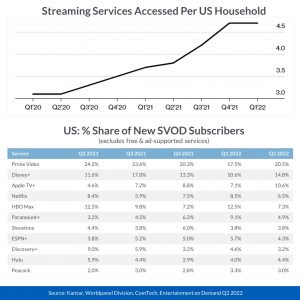

- Deceleration in service stacking fueled by elevated churn (8%)

- Value proposition crucial as providers compete for limited dollars and screen time

- Netflix subscriber share is falling as Prime Video, Disney+ and Apple TV+ make gains with new subscribers

ADVERTISING OPPORTUNITIES ARE PLENTIFUL & GROWING

Nearly all streaming providers feature ad-supported offerings… or soon will

Seventy years ago, the concept of television was very different from what it is today. When consumers turned on a TV set in 1955, they could choose from only three networks – ABC, CBS and NBC (and they had to get out of their chair to change the channel!). With each decade, that number of available network programming options grew larger and now, in 2022, the TV landscape has shattered into even more pieces.

Fragmentation is the hot concept in the video world (and the media world at large). With the increase in the digital footprint expanding the consumer’s access to video content, how consumers interact with media, especially TV, has changed.

According to MarketingCharts, Nielsen data shows that as of May 2021, TV households are spending more time streaming than watching broadcast television. As of 2022, 88% of U.S households have access to streaming services while the average household subscribes to five. While hours spent streaming continues to grow, the appetite for “stacking” is beginning to level off. The number of streaming services per household has increased only .3% since 2021, whereas the year prior saw a 1.7% rise. Targeting your audience no longer means just including a streaming platform but finding the right mix of those five streamers to reach your audience.

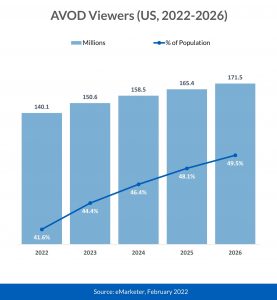

Fortunately, AVOD (Advertising Video on Demand) is growing in popularity. Netflix permanently altered the TV viewing experience in the 2000s, and the landscape has begun to shift again. While SVOD (Streaming Video on Demand) dominated the 2010s, the COVID-19 pandemic and inflation have accelerated growth towards AVOD. Concerns about prices have caused consumers to both “cut the cord” and view AVOD more favorably. Netflix, once famous for refusing to include ads in the viewing experience, announced recently they will offer an ad-supported tier by the end of 2022. Disney+ has also shared an intent to include an ad-supported tier, citing data from Hulu that over 70% of their subscribers have ads. The remaining 30% have opted for the more expensive ad-free subscription.

The amount of data available across streaming platforms allows advertisers to target based on more advanced layers than just age and gender, now including behavioral habits and household income. In order to capitalize, however, advertisers must be able to project and measure viewership across the fragmented landscape. The ability to optimally reach an audience, and to know who is watching and when, requires reliable data.

Finding and connecting with audiences across these streaming service providers can be a challenge. Many networks are beginning to move away from Nielsen, who lost its Media Ratings Council accreditation for local and national TV measurement in September 2021. Now, there is a need to provide cross-platform measurement that can accurately measure data across linear, digital, and OTT. New providers to the landscape include VideoAmp, iSpot, TVSquared, and comScore.

With this new available data, advertisers and marketers have expanded opportunities to target and curate buys towards consumers. However, no universally adopted measurement platform or strategy yet exists as providers continue to test and partner with different measurement platforms. There is no magic bullet. As we face this new horizon marked by an expanding field of converged TV providers and measurement platforms, the key for brands and advertisers lies in finding the right mix of media and measurement for optimally connecting with, and gauging impact on, their audiences. Solving this puzzle – or at least beginning to make actionable sense of it – will be the challenge, and opportunity, going forward.

Download our full 2022-23 TV Preview here. For more information contact us.