How The Pandemic Changed Audio and Video Habits… for Good

Download PDF

Introduction

The COVID-19 pandemic has changed many aspects of our lives over the past year, having a profound impact on our daily routines. Media consumption, specifically audio and video, were a huge part of the changes. With stay-at-home orders in place, we turned to our devices for news, entertainment, and escapism. Regardless of the reasons, we were consuming more media than before and were doing so in a multitude of different ways. While some of these shifts in media habits may have been temporary as we tried to fill the hours stuck at home and/or stay up to date on what was happening, other changes have become part of our “new normal” and many old consumption habits have been forever changed.

The COVID-19 pandemic has changed many aspects of our lives over the past year, having a profound impact on our daily routines. Media consumption, specifically audio and video, were a huge part of the changes. With stay-at-home orders in place, we turned to our devices for news, entertainment, and escapism. Regardless of the reasons, we were consuming more media than before and were doing so in a multitude of different ways. While some of these shifts in media habits may have been temporary as we tried to fill the hours stuck at home and/or stay up to date on what was happening, other changes have become part of our “new normal” and many old consumption habits have been forever changed.

Audio Overview

With the onset of the pandemic and quarantine orders in place, people immediately began driving less. Prior to the pandemic, roughly 71% of listening was taking place out of the home, according to Nielsen. As a result of decreased commuting, terrestrial radio felt a negative impact. Second quarter 2020 was hit the hardest with average quarter hour audiences dropping nearly 20% in PPM markets. In the time since, radio has been steadily recovering, as evidenced in Nielsen’s fourth quarter 2020 PPM data showing out-of-home listening back up to 67% of pre-pandemic levels as 2021 began. One of the most important aspects to keep in mind when looking at radio data is that consumption patterns can vary drastically by market due largely to the varying local impacts of the pandemic. Some regions have lifted many COVID restrictions, resulting in increased driving time and commute volume. There is no expected timeline for markets to fully return to pre-pandemic levels, and setbacks are still a possibility. Some markets are already there while others have further to go. Most PPM markets have already regained about 95% of their average quarter hour listeners as of April 2021.

Streaming/Digital Audio

While terrestrial radio was hit hard and had to weather some significant downturns during the pandemic, streaming audio saw quite the opposite effect. Aside from an immediate hit at the onset of the virus, digital audio ended up experiencing growth in 2020. With more people home and more technology to do so, people turned to streaming audio and time spent grew 8.3%, and it’s expected to increase another 4.8% in 2021, according eMarketer. More specifically, as people began new habits of working from home or virtual schooling, apps like Pandora and Spotify reported increased usage through smart speakers and smart televisions. They also experienced increased usage during different times due to these new routines. For example, weekday usage started to resemble weekend usage, eMarketer reported. Podcasts were also part of this growth. Since 60% of podcast listening takes place at home, according to Forbes, it makes sense that quarantining would have an accelerating effect on podcast growth. According to the latest Infinite Dial Report from Edison Research and Triton Digital, 41% of Americans 12+ have listened to a podcast in the last month, up from 32% in 2019. While the number of monthly listeners increases, so does the quantity of content consumed by each listener. In fact, weekly US podcast listeners averaged 5.1 podcasts per week. This increased usage was seen across demos and was not restricted to Millennials. Adults 45-54 saw an 88% increase in time spent with podcasts from Q4 2019 to Q4 2020 as reported in the Share of Ear report from Edison Research.

New Technology & Advancements

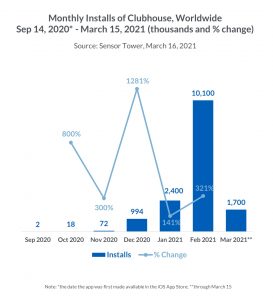

As time spent with digital audio increased, we also saw the emergence of social audio, with Clubhouse leading that trend. Clubhouse launched in March 2020 and has reached almost 13 million downloads in its first 12 months, according to WARC. It is only available on iOS devices and requires an invite for new users to gain access, but this has not stunted its growth. The main attraction of Clubhouse is the ability to participate and engage in discussions, events, and performances rather than passively observing. While Clubhouse might currently be the most downloaded social audio app, there are plenty of players jumping in on this trend including Twitter, which recently launched its version, Spaces. Existing social platforms like LinkedIn, Spotify, Discord, Facebook, and Instagram are all beginning to embrace social audio and new apps like Fireside and Stereo are also taking off. Right now, there is no advertising per se on Clubhouse, but marketers can participate through influencers, to host branded chats and virtual events and essentially engage with consumers across various sub-cultures. Since this arena of social audio is still evolving it is worth keeping an eye on to see how this progresses, especially as the pool of providers continues to expand.

Another advancement in the digital audio world is the idea of audio engagement. Seeking to capitalize on the growth in time spent with streaming audio, companies are trying to encourage interaction in what is often a screen-less world. Both Pandora and Spotify have been testing interactive voice ads. The idea is to utilize voice technology through smart speakers or mobile phones to allow listeners to interact with ads to request more information, free samples, or take some other call to action that could be done vocally. Since these are still in their early phases, proof of evidence is currently being constructed. Spotify has tested the concept with makeup brand Nars in the UK where they experienced positive results with listeners interacting to receive free samples. Pandora conducted its own research based on beta testing and found that voice ads had up to 10x higher “say-through rates” than click-through rates.

Video Overview

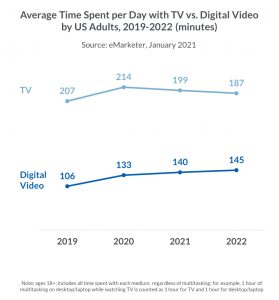

We see the changes that have occurred or have been accelerated because of the pandemic on the audio side but being forced indoors has led to a lot more video screen usage as well. During the onset of the pandemic, we saw increases in both linear TV viewing and digital video. However, as time passed linear TV gradually returned to pre-COVID levels while digital video use has remained elevated and is expected to sustain its heightened usage levels throughout 2021. In fact, eMarketer is estimating US adults will watch an average of 140 minutes of digital video per day this year, which is up from 133 minutes in 2020. TV continues to dominate when it comes to time spent but the gap between TV and digital video is rapidly shrinking.

Streaming Video

Looking closer at this increase in digital video, much of it can be attributed to the various streaming services that either experienced a surge or newly surfaced during the pandemic. Prior to COVID, growth of OTT subscription revenues in the US had been plateauing. However, in 2020, OTT subscription revenue grew by 41.2% year over year as reported by eMarketer. Part of this growth was a result of viewers being stuck indoors, but the pandemic also impacted many consumers’ disposable income, likely also fueling increased cord cutting. As streaming experienced a huge surge in usage, we also witnessed an increase in the number of services people were subscribing to and saw the phenomenon of service-stacking become more prevalent and widely accepted. According to a digital media trends survey by Deloitte, at the start of 2020 US consumers subscribed to an average of three paid streaming video services. By October that number had increased to five. Some of the newly-introduced services have even grown to be top contenders for what used to be the “Big 4”: Prime Video, Hulu, Netflix and YouTube. Disney+ surpassed their own goals by a considerable margin and have entered the streaming wars as a bona fide contender with over 100 million subscribers to date, according to Forbes. While this is a fraction of the 203.7 million subscribers Netflix currently boasts, it took them little over a year to achieve the same subscriber count that Netflix needed ten years to accumulate. The rise of the adoption of Disney+ illustrates how quickly the streaming landscape can change, especially with the increased consumption that is taking place, both in terms of time spent and service providers.

Connected TV (CTV)

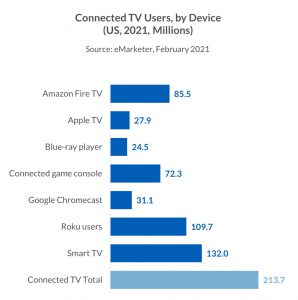

As streaming video services continue to grow, it comes as no surprise that connected TV follows the same trend, and in many ways, is driving it. Time spent with internet-connected devices continues to increase. From 2019 to 2020 there was a 33% increase in time spent by Adults 18+, with viewing climbing to almost 6 hours a week based on the latest Nielsen Total Audience Report. Looking at specific devices, most of the growth can be attributed to the increase in smart TVs followed by Roku and Amazon Fire TV devices. At present, smart TVs represent over half of the televisions currently in use, and 70% of TV households own at least one smart TV according to Hub Entertainment Research.

Addressable TV

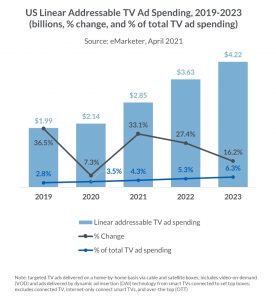

Addressable TV is another area that has been experiencing growth. While this is not a consumer trend, it is being driven by advertisers’ need to reach consumers, offering the best of both digital and traditional television advertising. Addressable TV combines the reach and scale of TV with the strategic targeting of digital. Nielsen reports roughly 54% of US homes are addressable-enabled, with recent growth largely driven by increased penetration of smart TVs and internet-connected devices like those mentioned earlier. More networks and cable providers are testing this area to help expand advertising possibilities. As the number of addressable-enabled households grows, both addressable inventory and ad spend will follow. eMarketer anticipates linear addressable TV ad spend to grow 33% in 2021.

Conclusion

Time spent with video and audio continues to increase each year, but the expanding cross-section of where and how they are being consumed is evolving even faster. Where listeners and viewers were once found solely on terrestrial radio and linear TV, it is now imperative to follow the audience across platforms, providers and devices, recapturing them wherever they are streaming while staying ahead of emerging trends that will drive further fragmentation. COVID-19 is (hopefully!) a once-in-a-lifetime event that has significantly impacted the way people consume video and audio. However, many of the habits we have seen during this pandemic – especially on the streaming side – are anticipated to continue long after COVID fades from our daily consciousness. It is more important than ever to follow listeners and viewers wherever they consume, staying ahead of evolving technology and trends to find the best ways to not only reach our audience but to engage with them.

For more information contact us.