Update on the Political Ad Scene for the 2020 General Election

OVERVIEW

While COVID-19 has had a tremendously negative impact on the US economy, political ad spending has not seen the same decline. In fact, largely due to the lack of in-person campaigning, spending on political advertising is at an all-time high. Consider that the Democratic and Republican conventions were presented virtually, and the three presidential debates and one vice presidential debate are now scheduled as virtual events. Candidates are also holding mostly virtual rallies instead of in-person events. Virtual rallies can add substantial numbers of people’s contact information to candidates’ campaign databases for direct messaging throughout the cycle.

While we normally see most of the general election spending during the political window of September 5th to November 3rd when presidential and House candidates are guaranteed the Lowest Unit Rate (LUR) on air, campaign ad spending started even earlier. Another factor that will affect spend timing within the political window is mail-in voting, which will be in play more than ever before, due to the COVID-19 effect on in-person voting.

SPENDING PROJECTIONS & RACES

Kantar recently boosted its forecast for this election season to $7 billion for campaigns and PACs on TV and digital media. A key driver for the increase is from Super PACs that can raise unlimited sums of money from corporations, unions, associations, and individuals to advocate for or against a candidate. Unlike traditional PACs, Super PACs are required to report their donors to the FEC. As of early August 2020, nearly 2,000 Super PACs reported total receipts of $1.1 billion. These PACs and issue advertisers do not receive the LUR given to federal candidates. These advertisers often cause preemptions, as they are willing to pay significantly higher rates to guarantee placements in order to air when they want, as stations will bump other lower-paying advertisers. This will lead to higher demand on inventory and can increase rates for non-political advertisers.

Over the past several years, there have been strong increases in ad spending for political campaigns. However, this growth trajectory does show signs of slowing, with the predicted growth for this cycle increasing 14%, versus 21% in 2018. Kantar is expecting 20% of this cycle’s spend to be invested in digital media.

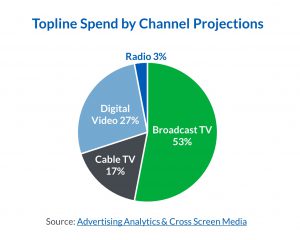

Another source, Advertising Analytics, in conjunction with Cross Screen Media, is projecting spend at $6.7 billion, with $4.9 billion on broadcast, cable and radio ads, and $1.8 billion spent on digital video. Much of that digital spend will be on Facebook and Google, which are still considered close to a duopoly in online advertising.

The election with the most spending will continue to be the US presidential race, with more than one third of all political dollars. But the House and the Senate are not far behind, with each expected to spend in the $2 billion range, according to Politico.

Fourteen TV markets are expected to have over $100 million in ad spending; Phoenix, Atlanta and Philadelphia are projected at $150 million each. Arizona has a very competitive Senate race with incumbent Republican Martha McSally running against Democrat Mark Kelly (astronaut and husband of former Arizona Congresswoman Gabby Giffords). Both Georgia Senate seats are up for reelection, and there are several congressional races in Pennsylvania and New Jersey. Pennsylvania is also a key battleground state. One of those key races is in New Jersey’s 2nd District. This House seat is currently occupied by Jeff Van Drew who ran as a Democrat but switched to the Republican party last year. His opponent is Amy Kennedy (wife of former Congressman Patrick Kennedy).

There are more than a dozen presidential battleground states where Trump and Biden need to focus in order to win 270 electoral votes. The “toss up” and “leaning” states with the most significant electoral votes include: Michigan, Wisconsin, Pennsylvania, Florida, Arizona, North Carolina, Minnesota, Ohio, Texas, Georgia. (Source: TVB for The Cook Report)

The most competitive Senate battleground states are Colorado, Arizona, Maine, Georgia, Iowa and North Carolina. In addition, California will see high volume due to ballot measures.

Political advertising on social media is a hot topic but advertisers may notice a much less significant impact on their campaigns than in years past. The focus of the political ad conversation is on Facebook and Instagram, as other major platforms such as Twitter, LinkedIn, and Snapchat have banned all forms of political ads. Looking across all digital media, Facebook owns 59.4% of all online political media spend with Google taking 18.2% and all other channels the remaining 22.4%. Another source, eMarketer, has predicted political ad spend on digital will cross $1 billion in 2020.

After hinting at banning all political ads in the days leading up to the election, Facebook states in their newly-announced policy that they will not accept new political ads during the final week. However, if the ads are placed before the final week, they can still run. Traditionally, this is when many campaigns or PACs will spend their remaining dollars on digital ads.

MITIGATING THE CROWDED AD SPACE

General election spending is expected to peak during September and October, leading up to November 3rd.

For advertisers with local advertising campaigns, be aware of the situation in your markets.

- Markets with “toss up” or heavily leaning campaigns are most vulnerable to pricing increased and inventory demands on broadcast TV. The TVB offers the TVB Guide to 2020 Political Races & DMAs, which provides detailed perspective.

- For early voting, the timelines vary from state to state. Expect TV/cable inventory to be most impacted by the early timelines. State by state in-person (early) voting timing, with COVID-19 voting information, can be found on vote.org and other sources.

- Spot TV CPPs may be increased to help keep orders intact. Expect and plan for preemptions. Prepare a plan for identifying acceptable makegoods and allowing for spot movement outside of the originally intended on-air weeks.

- Daypart mixes should be adjusted to reduce weight in news dayparts, which will be particularly affected. This is especially true for swing states.

- Streaming video (OTT) and online video are good options to support a linear TV campaign. This inventory is less vulnerable to rate increases and preemptions, as most digital vendors are not subject to the LUR rules.

Clients on Facebook can expect less of an impact on CPMs and inventory than in previous years. Many large advertisers have stopped spending on the platform due to updated revenue projections or issues with inventory relating to the fallout from COVID-19. Most of the entertainment, hospitality, and travel advertisers have not spent on the platform since March and other major brands joined the Facebook boycott and paused spend through the summer. In addition, changes in consumer behavior have resulted in more people spending more time on all social platforms – Facebook and Instagram included. The result is more users spending more time on Facebook but fewer advertisers are spending to reach them.

In addition, major events that drive advertising such as the Summer Olympics in Tokyo, music festivals, and sports have been cancelled. The increase in political ad spending in Q2 and Q3 will not overcome the loss of these events. Harmelin clients on Facebook are seeing CPMs down close to 25% year over year from March through August. It’s possible that the cancellation of in-person campaigning will open up additional dollars to be spent on Facebook political ads, but even that should not cause a major impact on campaign performance for most clients.

CONCLUSION

CONCLUSION

Harmelin Media’s advice on fall ad campaigns – if you have not done so, forge ahead immediately with your fall buying. Keep realistic expectations and be flexible to pivot to alternate channels, dayparts and weeks as needed. The political window is open, and it is time to jump in!