Breakfast Blues: Harmelin’s Analysis of Foot Traffic Shows Big Dip in Morning C-Store Visitation

Over the last few weeks, a team at Harmelin Media has been conducting a study of foot traffic to 42 different convenience store chains across the US, comparing visitation during pre-COVID, quarantine, recovery/reemergence, and summer periods. We used data from PlaceIQ, a leading provider of mobile location data and insights, to analyze consumer interactions with c-stores of all sizes.

Over the last few weeks, a team at Harmelin Media has been conducting a study of foot traffic to 42 different convenience store chains across the US, comparing visitation during pre-COVID, quarantine, recovery/reemergence, and summer periods. We used data from PlaceIQ, a leading provider of mobile location data and insights, to analyze consumer interactions with c-stores of all sizes.

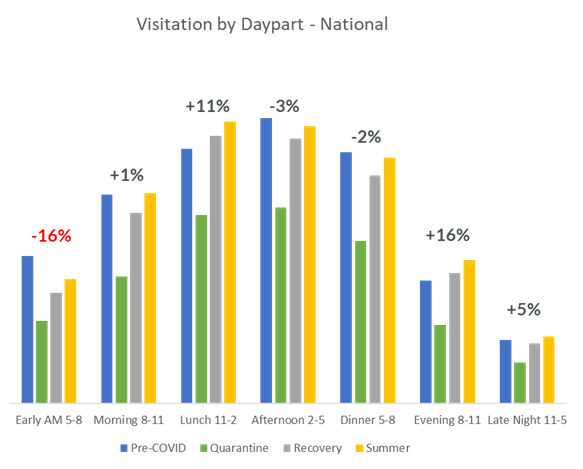

We were looking to find answers for some of the issues brands are facing as business continues to fluctuate throughout the country, and as marketers look for new ways to optimize media and resources to address this complexity. “The good news is that, generally speaking, traffic to convenience stores has rebounded to pre-pandemic levels,” said Harmelin’s Chief Revenue Officer, Scott Davis, who helped craft the report. “The one dramatic exception is in the early morning time frame, from 5 to 8 AM, where foot traffic levels this summer were still 16% below pre-pandemic levels.”

Adding additional insight, we were able to determine that this trend is purely a weekday issue, where traffic is down 19%, while weekends are +3% in the same 5-to-8 AM time frame.

Due to COVID-19, the abrupt halt in mid-March of white collar workers’ commute to the office has had a lasting impact on people’s habits regarding convenience store usage. More people are grabbing their morning coffee in their kitchen – a fact supported by the growth of premium coffee brands and single-serve coffee machines – instead of grabbing their cup of joe and breakfast on the way to the office. Add to that the knowledge that fewer parents are dropping kids at school since so many students are remote, and it is clear why the morning daypart hasn’t recovered the way the rest of the day has.

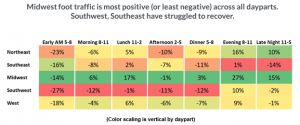

Not all c-store chains, nor regions of the country, have recovered from the pandemic the same way. Daypart to daypart, gains and losses in traffic from pre-pandemic period to the summer have been strongest in the midwestern US, including chains like Casey’s, Kwik Trip, QuikTrip and Kum & Go. The hardest-hit area of the country has been the southwest, impacting chains like Stripes, Allsup’s and Corner Store. That region of the country experienced the largest decline in traffic for six of the eight dayparts that were assessed.

Vice President Mark Hogan offered his insight into how convenience stores can reinvigorate the morning daypart considering changing consumer travel patterns. “We recommend targeted promotions specific to coffee and breakfast items that would incentivize someone to go out of their way or change their new habits. This could involve enhanced loyalty card benefits for morning purchases, early day gas discounts or other programs. Stores should use mobile location data to better target consumers who are still out and about during the morning to capture a larger share of available drivers. And if nothing else, each store should assess their staffing needs in the morning to reduce costs in the face of continuing traffic challenges.”

As Harmelin’s team began working on better ways to identify consumer trends in the c-store category, we decided to partner with PlaceIQ because its data allows us to understand consumer-level trends and the context upon which those visits are based. CEO and co-founder of PlaceIQ Duncan McCall shared that with us that “location intelligence data can strategically help agencies and brands monitor reemergence in different categories and regions, respond accordingly, allocate resources, and drive campaigns.” Utilizing and integrating location intelligence is critical to generate a complete picture of consumers, and is extremely helpful to strategically inform both business and media plans.